Energy Efficiency Investing Up: Three Reports Show Market Growth

Three recent reports show a range of energy efficiency markets on the rise, with demand-side management investment at a record level and demand response, smart building and nanogrid all growing.

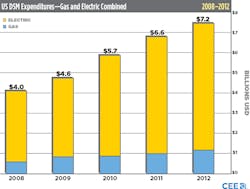

DSM spending, both gas and electric, reached a record $9.6 billion last year in the US and Canada, according to the Consortium for Energy Efficiency. The organization collected the data through its annual survey, this year of 361 utility and non-utility program administrators in 48 US states, plus the District of Columbia, and seven Canadian provinces.

Most of the money, $9.4 billion, came from utility ratepayer funds, like system benefit charges; the remainder was from non-ratepayer funds like wholesale capacity markets and the Regional Greenhouse Gas Initiative.

By comparison, spending was $8 billion in 2012, which represented a six percent increase over 2011.

In the US, commercial and industrial efficiency programs continued to receive the largest share of electric energy efficiency money. Next came residential efficiency, demand response, and low income programs, according to the CEE report. More than half of the 2012 electricity funds were spent on customer rebates and incentives.

Demand response spending among those surveyed was $1.13 billion in 2012, up nine percent over 2011.

The free CEE report is here.

Meanwhile, IDC Energy forecasts that smart grid building investment will grow 28.4 percent from $6.3 billion in 2014 to $21.9 billion in 2018. This leap comes after several years of slower-than-expected growth, says the report, “Global Smart Buildings Forecast 2013-2018.” Growth had been slow due to the economic recession and low electricity prices, the report said.

North America, Western Europe and Asia Pacific are likely to adopt smart building tech most aggressively over the next five years, according to the report.

IDC also found that drivers vary by region. In the United States, energy costs tend to drive adoption; in Germany it is an energy efficiency and environmental play; and in Japan, where the Fukushima disaster has created a need for energy, it is about doing the most with available supply.

More on obtaining the IDC report here.

Last, Navigant Research forecasts that the nanogrid market will grow from $37.8 billion 2014 to $59.5 billion in 2023. Nanogrids have been described as microgrids minus any energy supply. So they contain energy storage and controls.

Nanogrids are less complex than microgrids and face fewer technical and regulatory barriers, according to Navigant. The report sees nanogrids both complementing and competing with microgrids in the market place. It lists several well-known tech names that are working in nanogrid, among them Bosch, Eaton, Emerson Network Power, Johnson Controls, and NRG Energy.

Details about obtaining Navigant’s report are here.

About the Author

Elisa Wood

Editor-in-Chief

Elisa Wood is the editor and founder of EnergyChangemakers.com. She is co-founder and former editor of Microgrid Knowledge.