Research Update: Markets Expand for Energy Efficiency Products and Technology. Impact Seen on Energy Demand

Growth continues worldwide in markets for energy efficiency products and related technologies, according to several studies issued this summer. Meanwhile, energy demand keeps tracking upward in the US, but more slowly, due in part to energy efficiency.

Here are a few reports that paint the picture.

Navigant Research forecasts that the building energy management market – the monitoring and control systems in smart buildings – will more than double worldwide over the next seven years and reach nearly $5.6 billion in 2020.

Several trends are spurring this growth, according to Navigant. Buildings are using more digital controls; businesses are emphasizing energy efficiency and sustainability; and governments are mandating that building owners and utilities cut energy use.

Building energy management systems offer greater ability to see and analyze energy use, and thus influence occupants’ decisions and behavior when it comes to heating, cooling, lighting, appliance and equipment use.

Navigant also notes a trend toward using energy management systems in new ways, specifically for demand-side management and property management. This is bringing a broader set of players to the market.

Other recent Navigant reports reveal the following insight into the market:

- Cumulative worldwide revenue from smart meters for commercial and industrial businesses will total $19.1 billion from 2012 to 2020. Navigant sees annual revenue declining slightly after mid-decade, from $2.2 billion in 2014 to $2.1 billion in 2020.

- 2012 was a pivotal year for the fuel cell industry. It broke the $1 billion mark in revenue, with shipments of 124 MW, up from 40 MW the previous year. The growth spurt reflects the increased use of distributed generation worldwide. Previously, the fuel cell industry’s survival was in question, according to Kerry-Ann Adamson, research director with Navigant Research. Now it appears stronger and healthier than ever.

- The world will install 220 GW of distributed solar photovoltaics from 2013 to 2018 representing $540.3 billion in revenue. Some countries will see triple digit growth in the next five years. Prices are expected to keep falling but less dramatically than they did over the last three years.

- Future prospects for the LED lighting industry are mixed, according to Navigant. Global revenue for products in commercial buildings will grow from $2.7 billion in 2013 to more than $25 billion in 2021. But the lights last a long time, and users don’t have to buy them as frequently as they do conventional light bulbs. So LED revenue won’t hold up enough to keep big lighting companies afloat in the coming decade, according to Navigant. Thus, these companies are likely to increasingly move into lighting controls and services.

- Navigant sees demand response expanding well beyond its core base in North America. The number of sites employing DR is expected to expand from 10.3 million this year to 21.9 million by 2020.

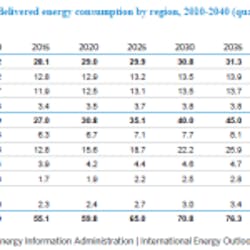

Meanwhile, it is clear that today’s emphasis on energy efficiency is affecting energy demand in advanced economies. Residential energy growth is expected to be only 0.4 percent per year through 2040 in the developed world, compared with 2.5 percent in developing countries, according to the US Energy Information Administration’s International Energy Outlook 2013.

Similarly, the outlook pegs growth in commercial energy at 0.9 percent annually in advanced economies compared with 3.2 percent in the developing world.

But that’s not to say the US isn’t still using a lot of energy compared with the rest of the world. For example, EIA estimated that US homes used 36.8 million Btu per capita in 2010 while India used 1.4 million Btu per capita, about 4 percent of the U.S. level. Even if the US isn’t increasing its energy demand as fast as it once was, enormous room still exists to bring more energy efficiency to its economy.

About the Author

Elisa Wood

Editor-in-Chief

Elisa Wood is the editor and founder of EnergyChangemakers.com. She is co-founder and former editor of Microgrid Knowledge.